Beyond 60: How Singapore’s Retirement Age Changes Affect the Workforce

Navigating Singapore's Shifting Sands: The Evolution of Retirement Age Policies

Ever paused to ponder how Singapore's retirement age has transformed over the years? It's more than just numbers; it's a reflection of our nation's journey, values, and aspirations.

Tracing the Roots: The Birth of Retirement Age in Singapore

In 1993, Singapore first introduced the Retirement Age Act*, setting the retirement age at 60. This move aimed to shield employees from age-based dismissals, ensuring that experience and wisdom weren't sidelined prematurely. By 1999, the government having recognized longer life expectancies and the invaluable contributions of seasoned workers, amendments to the Retirement Age Act were made. Retirement age was then nudged up to 62.

*fun fact: employers can reduce the wage of older employees but capped at 10% of the wages paid or payable to the employee when that employee attains or attained 60 years of age.

Adapting to New Realities: The Introduction of Re-employment

Come 2012, the labour landscape shifted with the Retirement and Re-employment Act (RRA). Beyond just a retirement age, this act championed re-employment of workers, urging employers to offer continued opportunities to eligible employees at the age of 65. There was also a target age of 67 for re-employment to be rolled out in the future. The message was clear: age shouldn't be a barrier to those willing and able to contribute.

Keeping Pace: Further Adjustments in Retirement Policies

The momentum didn't stop. In 2017, the re-employment age was officially increase to 67. The changes to the Retirement and Re-employment Act (Cap 274A) - under Amendment of section 7A.

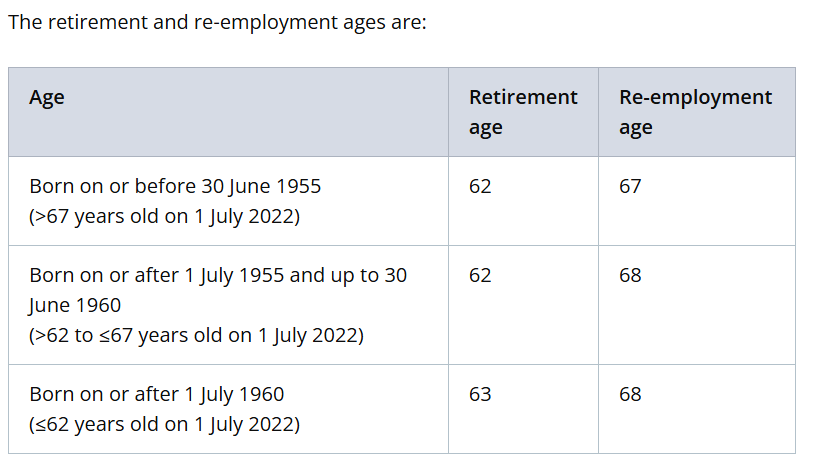

Fast forward to 2022, changes were abound and it was announced that the retirement age was elevated to 63, with re-employment extending to 68 (for those born on or after 1 July 1960).

There are future plans in discussion during 2024, which was to raise the retirement age and re-employment age to 64 and 69 respectively by 1 July 2026, aiming for 65 and 70 by 2030.

We are currently 1 year and 5 years away from these milestone as of the writing of this article (2025).

Why These Changes? Understanding the Drivers

Several factors underpin these shifts:

- Ageing Population: With a rapidly ageing populace, policies are evolving to harness the potential of senior workers.

- Workforce Dynamics: Declining birth rates mean a tighter labor market. Encouraging older workers to stay active helps bridge potential gaps.

- Economic Considerations: Ensuring that the Central Provident Fund (CPF) remains robust is crucial. Aligning retirement with longer working years aids in this endeavor.

The Ground Reality: Public Sentiment and Challenges

The public's response is a mixed bag. Many appreciate the financial stability and sense of purpose that extended employment brings. However, concerns linger about ageism, especially when reports indicate that age-related biases accounted for about 24% of discrimination complaints between 2018 and 2022.

Looking Ahead: The Road to 2030

As we march towards 2030, with retirement and re-employment ages set to reach 65 and 70 respectively, it's imperative to foster an inclusive work environment. This includes addressing age biases, promoting lifelong learning, and ensuring that policies resonate with the needs of all Singaporeans.

Final Thoughts

Singapore's retirement age policies mirror our nation's resilience and adaptability. As we navigate these changes, it's upon each of us—employers, employees, and policymakers—to champion a future where experience and youth coalesce seamlessly.

How do you perceive these shifts in retirement policies? Are they steps in the right direction, or do they pose new challenges? Share your insights below.

Member discussion