Pay more for house ownership (SG edition)

With recent news of high sale transactions happening around in Singapore, it is no wonder the Singapore Government is stepping in to regulate the market.

3 bungalows at Nassim Road sold for S$206.7 million

With cases of HDB moving up to the $1 million price mark, and Good Class Bungalows hitting a new high after Covid-19, it is quite telling that Singapore is attracting more ultra-rich to the island.

Let's run a recap of what happened in 2022:

| Policy | Description |

|---|---|

| Loan-to-value (LTV) Limit lowered | Only able to borrow up to 80% of the property price. |

| Wait out period | 15 months of wait-out period once owners dispose their private properties before they are allowed to purchase a non-subsidized HDB resale flat. |

These measures were introduced due to an upward trend in housing demands. The pandemic hit and the delays in the housing had caused people to look for alternative such as purchasing available properties, triggering prices to go higher. It also had a secondary effect on rental hikes.

All these set against the backdrop of the current global climate I believed pushed Singapore to be one of the few places that remains very attractive to cash-rich or the ultra riches to be their next home.

Let us take a look at the total residential unit (excluding collective dwellings) in Singapore since 2000. Over the years, it seems that there has been more residential places constructed, in tandem with the increasing numbers of HDB flats built.

The latest data (2022) shows that a total of 1,526,540 residential units are available, out of which 1,102,012 comes from HDB. The remaining 424,528 are the ones the private properties available which happens to also include GCBs.

72% of residential units belong to government housing.

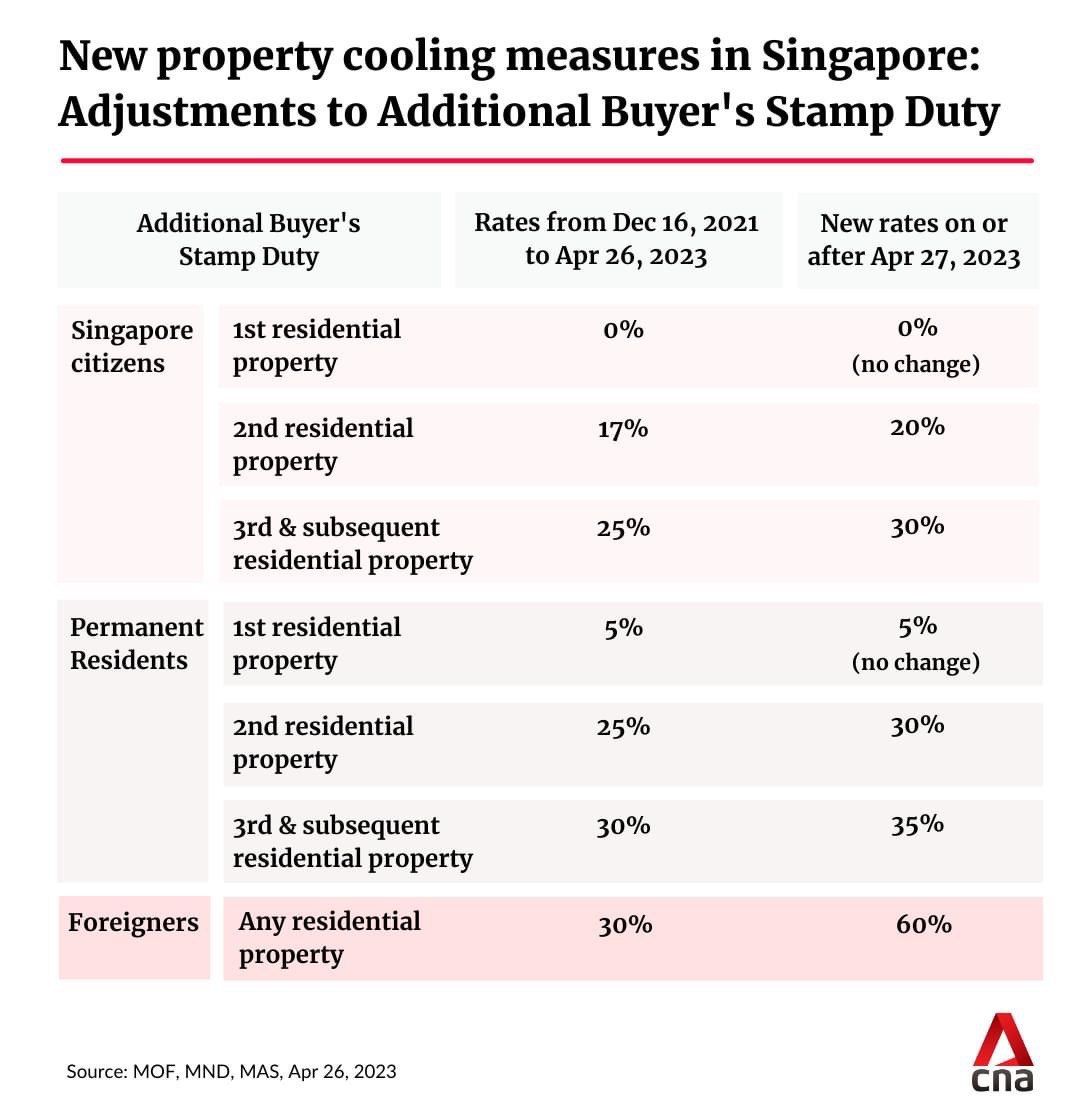

So on 26 April 2023, the Singapore Government announced that Additional Buyer Stamp Duty (ABSD) will be raised starting from 27 April 2023. The summary is shown below:

While I try to make sense of the policy in the current climate, these are my thoughts:

The biggest restrictions are on foreigners, and people who are to acquire 2nd properties – these already precludes those who want to purchase resale flats

Furthermore, the rich will convert to SPR and still go ahead to purchase private properties regardless, as pricing is not the limiting factor.

This policy seems to aim particularly at clamping down on prices for private properties – the 28% of available residential units including GCBs.

In all, let us just keep in mind that 1 policy alone is hard to achieve the intentions which the Government is steering towards. We have to wait out to see subsequent policies which will be rolled out this year, perhaps from other areas such as migration, housing or loan policies to understand the greater impact this new rule has on us.

Member discussion