Things you need to know about Monetary Policy in Singapore.

[April 2023]

Monetary Authority of Singapore (MAS) seeks to inform the public of their monetary policy stance every 6 months, in each year's April and October.

Folks, remember to check in on every April and October!

Unlike other countries, Singapore adopts a Singapore Dollar Nominal Effective Exchange Rate (also known as S$NEER) as the only monetary policy for the country.

In essence, S$NEER is a measure of the value of Singapore Dollars (SGD$) against the currencies of other countries which Singapore trades with. The weighted average of the exchange rates between SGD$ and the currencies of Singapore's major trading partners (including US Dollar, Euro, Yen, Yuan and others) is taken into account when measuring S$NEER.

This metric – S$NEER is a paramount to Singapore's monetary policy as it facilitates Singapore's government to monitor and manage the exchange rate of SGD$, which can impact directly on the country's economic performance. Take for example, if S$NEER is moving upward and becomes elevated, the exports from Singapore may be hit as they get increasingly expensive, resulting in lower demand from foreign buyers.

On the contrary, in the scenario where S$NEER is low, the imports from trading partners are overpriced and can lead to inflation.

On S$NEER: Too high, nobody wants to buy. Too low, everyone pays the brunt.

However, we also need to be aware that this policy may result in over-reliance on exports where businesses prioritize exports over domestic markets.

Moreover, the policy may not be a catch-all, end all policy as it may be slow to reflect other factors such as global economic conditions, wars etc having influence on Singapore's economy.

Indeed, hard work and acute foresight from the government are some of the necessary ingredients to manage the S$NEER within a tolerable band in order to preserve the sustainability of the economy.

We are in the midst of a Stagflation!

There was a recent MAS policy statement on 14 April 2023 –

In this statement, MAS has reviewed and assessed the policies which were made last year and provided a brief update of the current economic conditions, as well as, forecasts for Singapore and the world.

There are neither new policies nor new adjustments made this time round.

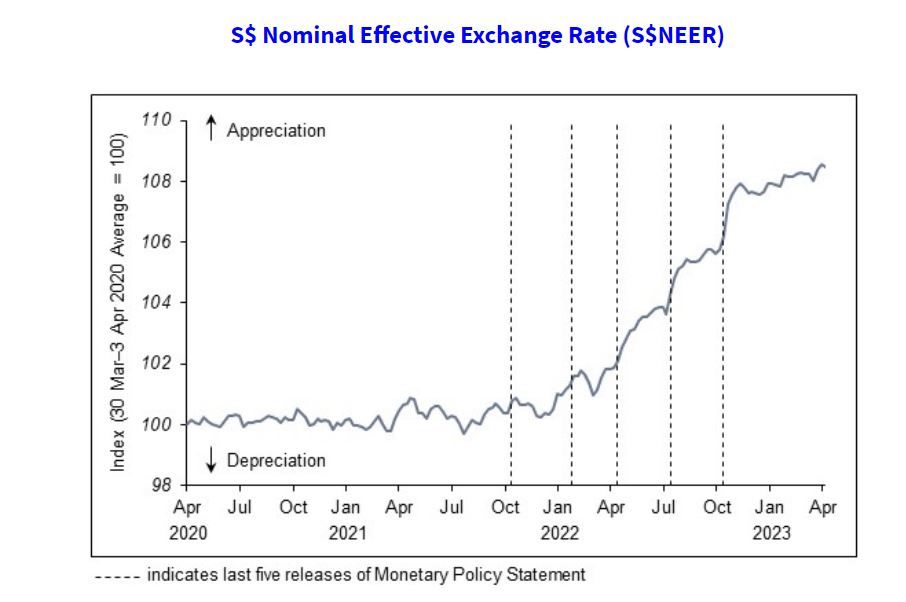

A graph of S$NEER against time (above) was also released in the recent statement and we can identify the tightening of 5 monetary policies (the vertical dotted lines) within a 12 months time frame. The reasons to tighten the monetary policies in 2022 were to:

1) reduce inflations due to imports --> remain the high buying power for commoners.

Should I buy my Chanel bag for investment? Maybe you should...

2) limit rising costs within the country --> going back to point 1, so purchase of raw materials/food are affordable due to stronger currency value.

3) allow inflation to rise slower over time so that there are still economic growth --> costs will definitely rise and then plateau.

MAS further analysed that Singapore's GDP growth is estimated to shrink down to 0.5% – 2.5% for 2023. For inflation, it will generally continue to stay afloat at the higher spectrum and gradually taper off towards the end of the year.

MAS Core Inflation is expected to average 3.5 – 4.5%

In all, we are facing a bumpy road ahead this year. Do buckle your wallets or else find more business making opportunities to support your lifestyle.

Member discussion