CPF Contribution Rates 2023: Complete Singapore Guide & Calculator

There is an increase to Central Provident Fund (CPF) contribution rates in 2023 to member's Special Account (SA). The reason is to provide Singaporeans a substantial aid in their retirement years.

Background

CPF was introduced in 1953 before coming into effect through the CPF Act on 01 July 1955.

What is CPF?

CPF is a compulsory saving scheme where the employers and employees contribute a percentage (a.k.a Contribution Rates) of their monthly income to the provident fund.

The Contribution Rates can be interpreted as a combination of contribution by 1) Employee and 2) Employer.

This move came about as the workers back then had no retirement benefits and would largely depend on their own personal savings, which were unsustainable. This prompted the government to look into this problem and the idea of CPF was born.

Over the years

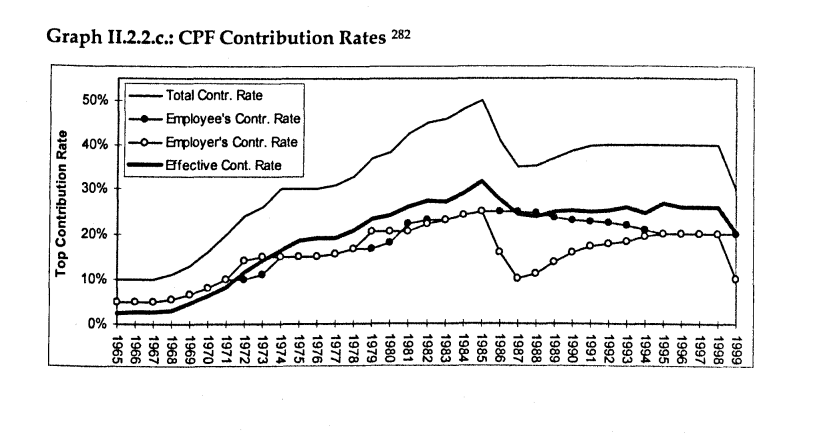

The graph below shows the changes of the CPF Contribution Rates since its inception until 1999. We can see that the Contribution Rates were on the climb to a peak of nearing 50% at one point and falling to below 10% over the course of its lifetime.

CPF Contribution Rates

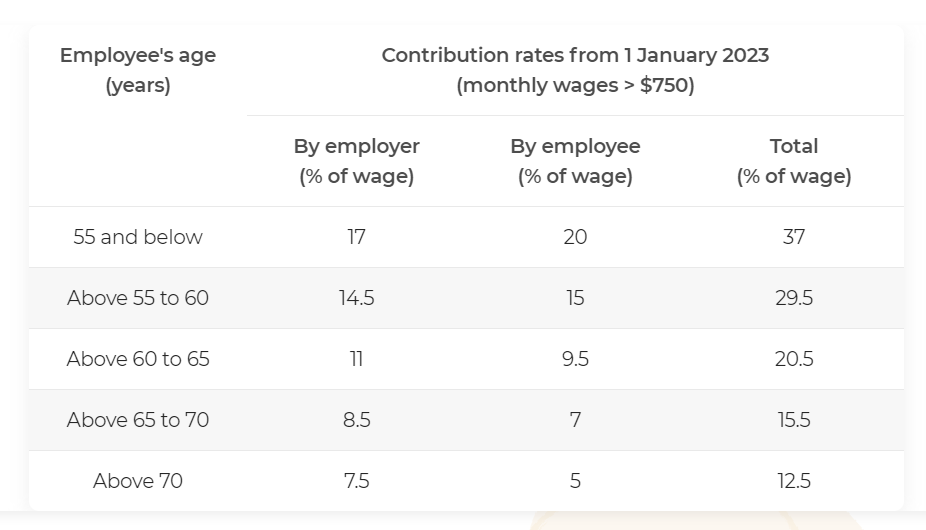

The current rates contributed by employer and employee (as of 2023) are as follow:

Looking at the table above, and referencing the interpretation of Contribution Rate, one can see that the total Contribution Rates below the age of 55 is 37%. Out of this 37%, 17% is contributed by the employer, while the other 20% is contributed by the employee themselves.

If you’re a Singapore Citizen or Permanent Resident employee earning total wages of more than $50 per month, your employer must contribute CPF for you.

With the increase of age, the employer and employee are required to contribute lesser to the provident fund. For instance, a person between the age of 65 to 70 require a total contribution of 15.5%. Out of this 15.5%, 8.5% is contributed by the employer, while the other 7% is contributed by the employee themselves.

Example:

Scenario 1: An adult in his mid-career, aged 31, and earning a gross income of $5,000 per month. Let us take a look at his take home pay, contribution from the employer, and contribution from himself.

| Description | Amount |

|---|---|

| Gross Income | $5,000 |

| Employee Contribution Rate (20%) | $1,000 |

| Employer Contribution Rate (17%) | $850 |

| Take-home Pay | $5,000 - $1,000 = $4000 |

| Total CPF Contribution (37%) | $1,850 |

There is a salary ceiling on the contribution rates. This is further explained in my previous post which outlined the new changes that was introduced in 2023 budget. Do head on there to understand in depth on what are the changes.

Don't leave it to chance and always do your own due diligence.

Phew!

One part of CPF explained.

Moving on to the next section...

CPF Allocation Rates

Now that we understood more on the Contribution Rates, we will then look at where these money flows into.

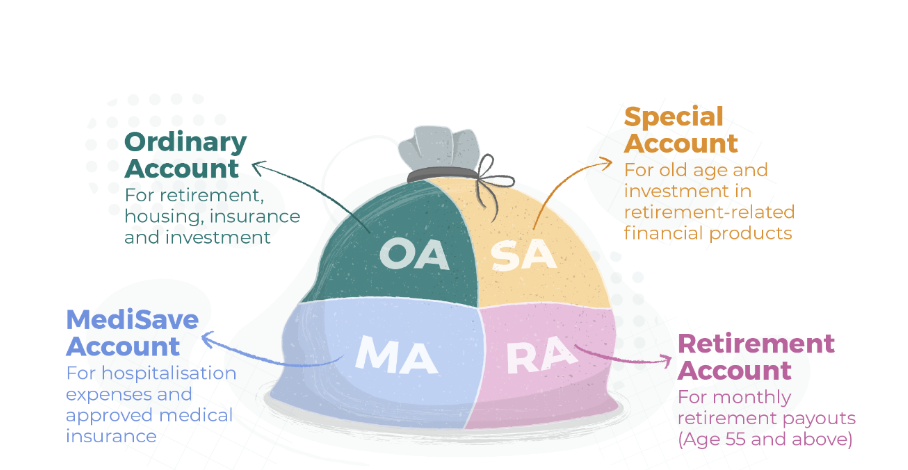

In CPF, the funds are distributed into these accounts:

| Account | Description |

|---|---|

| Ordinary Account (OA) | The funds distributed into this account are expended for housing, insurance and investment. It is also meant for retirement |

| Special Account (SA) | The funds distributed here is for investment-related financial product and old age. |

| Medisave Account (MA) | The funds distributed into this account are meant for hospitalisation expenses and approved medical insurance. |

| Retirement Account (when you are above 55 and above) | This account is created once you reach 55 years old. The funds are transferred from both OA and SA when you are 55 years old. |

The OA always have the highest ratio as compared to MA and SA while we are younger.

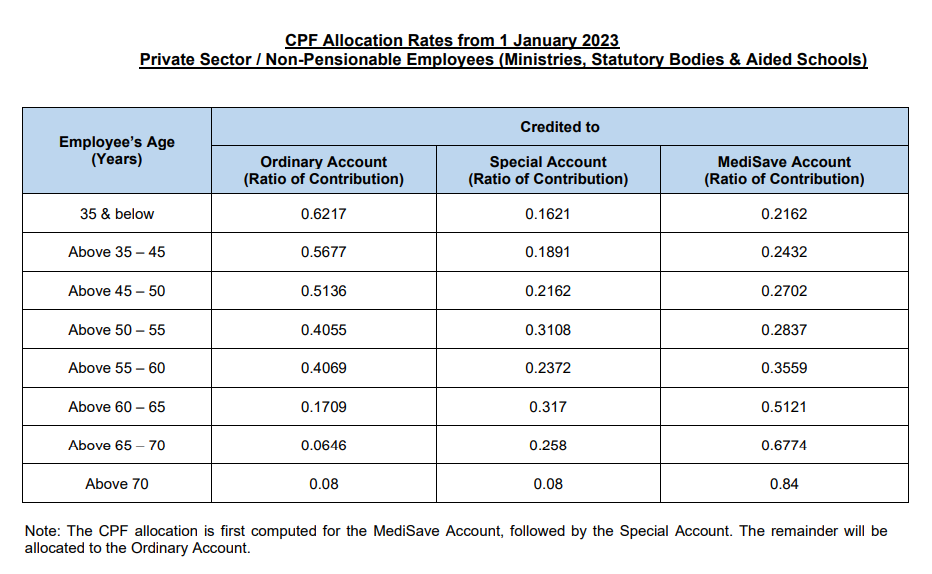

CPF recently published the allocation rates for 2023 as below.

Tip: Try to maximise your pay before 35 so that you can get the maximum ratio for OA.

Example:

Continuation of the same example as above

Scenario 1: An adult in his mid-career, aged 31, and earning a gross income of $5,000 per month. The total contribution is $1,850. Let us take a look at the amount of funds which flows into his various accounts within CPF.

| Account | Distribution of funds |

|---|---|

| Ordinary Account (OA) | $1,850 - MA - SA = $1,150.15 (rounded to 2 decimal place) |

| Special Account (SA) | $1,850 * 0.1621 = $299.89 (rounded to 2 decimal place) |

| Medisave Account (MA) | $1,850 * 0.2162 = $399.97 (rounded to 2 decimal place) |

| Retirement Account (RA) | -Not applicable- |

| Total CPF Contribution (37%) | $1850 |

In all, it is important to understand how CPF works, so you are able to plan with an end in mind.

This guide was also made to allow more understanding of CPF for the young adults who are just starting to work. It is also friendly refresher to those who are in the workforce for a while.

CPF Calculator

I completed a simple CPF calculator for ease of check here:

*Note:

1) The calculator is free to use and may not be accurate. Please always check with CPF website for more information.

2) The assumption is that the take home pay is based on cap of CPF salary ceiling (at $8,000) which will be implemented by 2026.

3) For personal use only.

you can support me with the calculator below:

Member discussion