Business Structures (SG Edition)

First do, then pick up the skills while you hustle away

In Singapore, during our formative educational years, we rarely hear about starting your own business.

Why?

This could largely be because as a country which depends heavily on humans as their only resources, Singapore's government expects that the people contribute to the economy through the cycle of 9am to 5pm work culture. However, in recent years, and onset of COVID-19 coupled with technological advancements, there are now more and more job opportunities and lifestyle choices available to the masses.

Furthermore, more and more people are looking past the traditional job expectations and prefer to start their own line of business and be their own boss.

To navigate the webs of Singapore's business structure, let us first have a look at the available vehicles of setting up a company:-

The first step to setting up is to register with ACRA

| Business Structure | Description | Legal Exposure and Risk | Adminstrative Cost |

|---|---|---|---|

| Sole Proprietorship (one owner) | Business operated by one individual/company or limited liability parternship | The owner has unlimited liability, meaning their personal assets are highly at risk. | Low and minimal regulatory requirements (refer to ACRA Website) |

| Limited Partnership | The partnership which includes at least two partners; one General partner and one limited partner. | The General partner has unlimited liability. | Medium. Accounting records is required to be properly kept |

| Limited Liability Partnership (LLP) | A partnership with at least 2 partners. No maximum limit. | A separate legal entity from its partners and partners have limited liability | Medium to high. Accounting records is required to be properly kept and annual filings required. |

| Company | A business form which is a legal entity separate and distinct from its shareholders and directors | A separate legal entity from its members and directors. | High. Proper secretarial and accounting records must be in place. There is statutory requirements to hold meetings and annual filings are required. |

*The table is not exhaustive. Please refer to ACRA for more information and do your own due diligence.

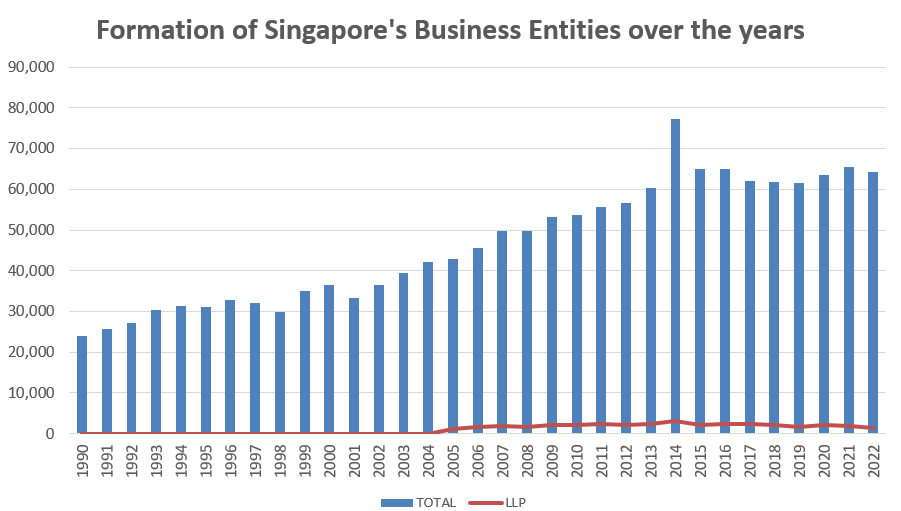

Extracted above are the total number of registered business in Singapore from 1990 to 2022. As we expect, the numbers of people starting businesses have been on the rise, and a peak was formed during 2014.

According to Singstat, as of 2022, there are a total number of 64,305 businesses here.

Yes, Yes, Yes.

After knowing the type of structures available, next comes the cost ($$). How much does setting up a company hurt your bank account.

Do not fret, it is unlikely to cost you an arm and a leg. As of May 2023, the set up fee for all structures is relatively reasonable at $115 for 1 year registration ($15 name application and $100 registration fee) and $175 for 3 years registration ($15 name application and $160 registration fee) except Company. In the case for the Company, the set up fee is $315 ($15 name application and $300 incorporation fee).

At this point, I am pretty sure most of us are half sold on starting but why bother when I am already working full time? Who have the effort and what do I stand to gain?

Let us delve deeper on the benefits of starting a business in Singapore:-

| Benefits | Description | Impact |

|---|---|---|

| Easy and fast Incorporation | Usually takes 15 minutes to register the business. | This means that the company is able to apply for corporate bank account. Apart from this, the company is on track to apply for permits/licenses faster. |

| Lower Tax Rate | Corporate is taxed at a flat rate of 17% of their chargeable income. This is one of the lowest corporate tax in the region, with Hong Kong coming in at 16.5%. |

As of YA2023, there are no corporate income tax rebate. However, there are other schemes available to help businesses. |

| SG Schemes | The Budget 2023 has unveiled several schemes. These schemes include Progressive Wage Credit Scheme, Senior Employment Credit, Enhanced Enterprise Financing Scheme – Working Capital Loan, Energy Efficient Grant, Enterprise Innovation Scheme, Corporate Volunteer Scheme, to name a few. |

Expect assistance on employment support and cost pressures. Companies can look towards having sustaining innovation and participating in corporate volunteerism. |

*The table is not exhaustive. Please refer to GoBusiness Singapore for more information and do your own due diligence.

We may be comfortable leading a 9 to 5 job, but we will never get rich.

With all the benefits laid down, the only thing lacking is to TAKE ACTION!

In all, this post is dedicated to individuals who are looking for opportunities and trying to find a footing in Singapore where the cost of living is getting higher each day.

Member discussion